Have you ever had that feeling of frustration that comes from buying an item at a store, then seeing it substantially cheaper at another shop?

It can also happen with your home loan. And if you’re refinancing your mortgage, it’s smart to shop around for a better interest rate.

The reality is that, even though your interest rate might have been fantastic when you first applied for your mortgage, other lenders are competitive and can have better deals on offer.

And if your current interest rate is not ideal, the end result can be many thousands of dollars wasted over the life of your home loan.

The good news, though, is that you can take practical steps to fix the situation.

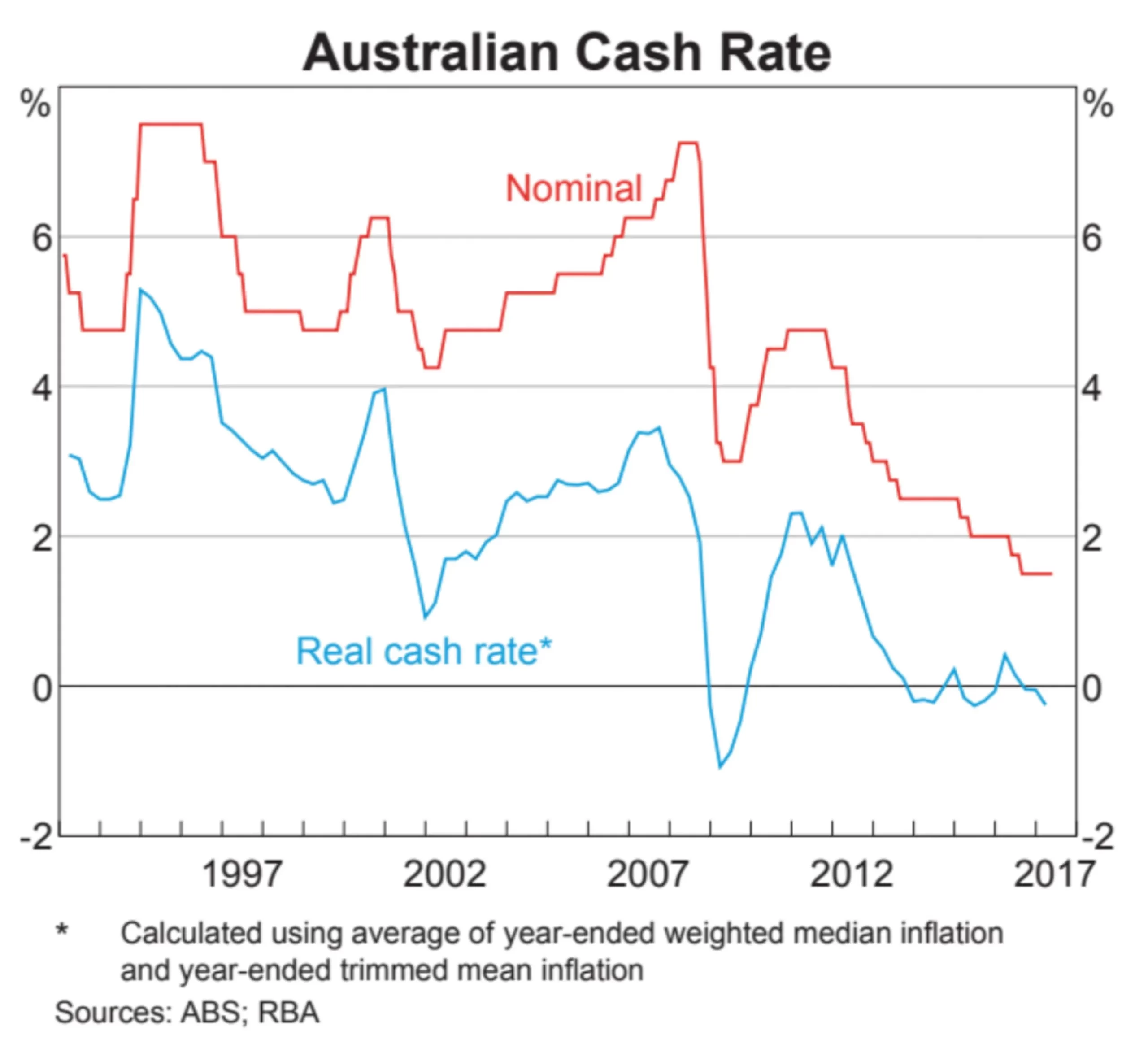

In the current Australian home loan market, there are always discounted interest rates available and by comparing the different options available to you, there could be valuable savings to enjoy.

To help you refinance your home loan, try these tips to save money on your mortgage by shopping for a better interest rate deal.

1 – Improve Your Credit Rating

Even if you already have a home loan and you are keen to refinance your mortgage for a better deal, improving your overall credit rating can still have an impact.

With a healthy credit rating, you have more choice available – and the more options you can access, the better chance you have of securing a competitive interest rate.

Always pay utility bills on time (or, better yet, pay them well before the due date and save money with the earlybird discount).

When it comes to credit cards, get rid of any unnecessary extras and keep the available balance as low as possible on the one you do keep. By reducing available credit and avoiding late payments and defaults, you give your credit rating the best possible boost that lenders appreciate.

2 – Research The Rates

In these days of the online world, when comparison rate websites put information at our fingertips, shopping around for great interest rates is easier than ever. The days of approaching your bank for a home loan because of some sense of customer loyalty are gone and the truth is that the interest rates deals that can benefit you the most may be found in some unexpected places.

For access to the best interest rate comparison, talking to an experienced mortgage broker is always recommended. Researching available rates is more than just comparing numbers on a screen – it’s about understanding which lenders service which client demographic best and what unique criteria each lender has as a potential barrier to your entry into doing business with them.

By putting some effort into researching a great rate that is actually available to you, you can save tens of thousands of dollars – and years – from your home loan.

3 – Be prepared to switch banks

Switching banks for a better deal on your mortgage payments is not the enormous hassle it once was. Make sure you do your research – checking application fees and other associated costs will reveal the true picture of the complete cost of your mortgage. If crunching the numbers reveal that switching banks really will save you money in the long-term, it is worth making the switch to save money on your interest rate for the life of your loan.

4 – Ask For A Better Interest Rate

Sometimes, it’s possible to access the benefits of these competitive interest rates without even having to change home loans. Depending on your lender and the history of your loan with them, simply letting them know that you are keen to shop around for a better interest rate can be enough to get them to offer you a lower interest rate in an effort to hold on to your business.

Try asking your current lender this question: “I’m shopping around for a better interest rate and I want to know if you can give me a better deal on my mortgage?”

Or, better yet, get an experienced mortgage broker to do it for you. By having a thorough understanding of different interest rates available at a wide variety of lenders, professional mortgage brokers are in a strong position to negotiate a more positive deal.

For more information about refinancing your property, talk to our team today.