Planning to upgrade or downsize your home? A simultaneous settlement lets you buy and sell on the same day – avoiding the cost and stress of bridging loans or short-term rentals. But pulling it off takes a little smart planning and teamwork.

What is simultaneous settlement?

A simultaneous settlement means the funds from the sale of your old home are used, in real-time, to complete the purchase of the new one.

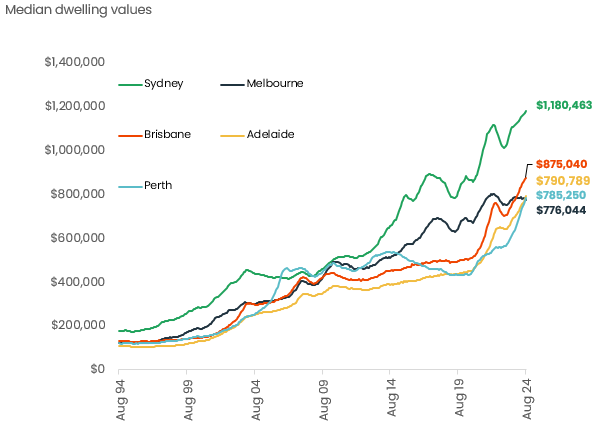

This ensures a seamless transition and is a common strategy in competitive property markets like Sydney or Brisbane, where property prices are high and timing is important.

How does simultaneous settlement work?

Achieving a simultaneous settlement requires planning and communication between all parties involved, including you (the homeowner), the buyer of your old property, the vendor of your new property, both real estate agents, two conveyancers and the lenders for all parties.

Should you buy first or sell first?

Before coordinating the moving parts of a simultaneous settlement, you first need to decide whether you should buy or sell first.

In a rising market, many people choose to buy first. This gives you time to find the right property and potentially buy before prices climb even higher. The downside is that if your current home takes longer to sell or goes for less than expected, you could be left covering two mortgages (bridging finance) or falling short of what you need to complete the purchase.

In a softer market, many buyers believe selling first is the safer bet. This removes the pressure to accept a low offer and gives you a clear budget for your next purchase. However, you may need to line up short-term accommodation if you can’t find a new home quickly.

Whatever your approach, extended settlement periods and smart negotiation strategies, like making your offer subject to the sale of your current property, can help line up both transactions and increase your chances of a same-day settlement.

The process typically involves:

1. Getting pre-approval

Before you start house hunting, speak to an experienced home loan broker about your mortgage. A good broker can assess your financial situation, develop a strategy and help you secure pre-approval for your next home loan. This gives you a clear understanding of your borrowing capacity and demonstrates to real estate agents that you are serious and financially prepared.

2. Aligning settlement dates

Once you’ve found a buyer and your next property, the next step is to negotiate settlement dates that match. This can take skilled negotiation from agents, buyers’ advocates (if you use one) and conveyancers on both sides.

During this process, the agents may request a longer settlement period, perhaps 60 to 120 days, on both contracts to provide a sufficient buffer to get everything in order. You may also be required to be flexible in both your selling price expectations and your new property criteria.

3. Coordinating home loans

Once contracts are exchanged and settlement dates are set, your mortgage broker will begin preparing the formal loan application for your new property. At the same time, the lender for your current mortgage will be notified of the upcoming discharge.

There’s a decent amount of paperwork here, and timing is everything. Thankfully, your mortgage broker does the heavy lifting for you. Your home loan broker will work closely with both lenders to ensure the funds from your sale are released in time to fund your purchase. This may also include managing any loan top-ups or redraws, and ensuring valuations are completed promptly.

4. Managing legal communication

Each property requires a conveyancer or solicitor to handle the legal aspects of settlement. For simultaneous settlement to succeed, both conveyancers need to communicate regularly to make sure that:

- All documentation is accurate and complete

- All funds are accounted for, including the deposit and balance payments

- The order of settlements is correctly arranged through PEXA (Australia’s digital property settlement platform) – the sale usually settles just before the purchase

If the timing is off, the entire chain can be delayed, so having reliable legal support is essential. In some cases, especially when buying before selling, your solicitor may recommend including a “subject to sale” clause in the contract. This condition allows you to make a purchase offer that’s only binding once your existing home has sold, helping reduce financial risk, but this can reduce the strength of your offer.

5. Completing both settlements on the same day

On settlement day, both properties settle, usually within hours of each other. Typically, your current home will settle first, with those funds immediately directed (via your lender) to fund the purchase of your new home.

If all goes according to plan, the keys to your new home will be handed over that afternoon.

What could go wrong with simultaneous settlement?

Unfortunately, if one settlement is delayed, it can create a bit of a problem.

Some common risks include:

- Delays with finance approval: It is helpful if your new home loan is fully approved and ready in advance. That’s why working with an experienced mortgage broker can make all the difference.

- Issues with the buyer’s finance: If your buyer’s loan isn’t ready, your sale could fall through or be delayed, which then impacts your ability to settle your purchase.

- Contract mismatches: Settlement dates must be exactly aligned in the contracts of sale and purchase.

- Property defects discovered late: Structural issues, pest problems or building compliance matters identified during final inspections can derail transactions at the last minute.

- Legal documentation delays: Missing certificates, title issues or incomplete paperwork can prevent settlements from proceeding on schedule.

To reduce these risks, it’s important to plan ahead, give yourself buffer time and ensure your loan application is complete and accurate from the outset.

How can an expert mortgage broker help with a successful simultaneous settlement?

A great mortgage broker can help manage the timing of your home loans to ensure your finance is in place when you need it.

This can involve:

- Pre-approval guidance: A mortgage broker can assist buyers in securing conditional approval, helping you make a confident and competitive offer when purchasing a property.

- Loan structuring: Whether you are upsizing, refinancing or unlocking equity, a broker will structure the finance to support the timing of both the sale and purchase.

- Coordination: The broker coordinates with your solicitor, conveyancer and lender to ensure the financial side of the settlement stays on schedule.

- Plan B options: If simultaneous settlement becomes too risky or tight, a broker can walk you through alternative strategies such as bridging finance or short-term refinancing.

Simultaneous settlements are actually quite common and when managed properly can remove a lot of stress and complexity (ie no bridging finance is required), but they require careful planning, strong communication and the right professionals on your side. An experienced home loan broker can make all the difference, ensuring your finance is ready, your timing is right and your move goes smoothly from start to finish.

If you’re planning to buy and sell on the same day, AXTON Finance can help. As a trusted mortgage broker in Melbourne, we’ll coordinate with your legal team and lender to keep everything on track. Email us at [email protected] or click here to get in touch.