Victoria’s housing market has been under intense pressure in recent years, with supply struggling to keep pace with demand.

In 2023, the state government pledged to facilitate the building of 800,000 new homes by 2034, a target that requires at least 80,000 new homes to be completed each year.

However, the state fell short in 2024. Australian Bureau of Statistics (ABS) data shows only 60,220 dwellings were completed in 2024. While that’s an improvement on 2023’s 56,435, it’s still 20,000 homes short of the annual goal.

At the same time, Victoria’s population grew by more than 146,000 people in the 12 months to September 2024. This increase of 2.1% annually was the second-fastest growth rate in the country, according to the ABS.

More people means more pressure on housing – making the supply gap even more urgent.

How the shortage happened

Several key factors explain this shortfall:

1. Labour and skills shortage

One of the biggest constraints is a chronic shortage of skilled tradespeople and construction workers. In October 2024, the Housing Industry Association (HIA) estimated the country would need an additional 83,000 tradies to reach national housing targets.

Both the HIA and Master Builders Association report losing residential construction workers to other sectors, particularly government infrastructure projects. Meanwhile, the pipeline of apprentices and skilled labour isn’t being replenished fast enough.

Without enough workers, construction slows, pushing back completion timelines and limiting the number of homes delivered to market.

2. Supply chain disruptions and rising costs

Global instability and supply chain challenges over recent years have increased the cost of building materials and delayed their delivery.

According to Ray White, construction costs have started to moderate. In March 2025, Victoria was the only state to record a decline in construction costs, when prices dropped 1.9% annually. This marks a clear shift from the cycle’s peak in mid-2022, when prices were growing 25% or more annually.

However, moderating costs don’t mean affordability has returned. New homes remain expensive to build – and to buy.

3. Tax and regulatory burdens

Victoria’s relatively high property taxes, including recent land tax hikes on investment properties, have discouraged investors, reducing their willingness to invest in new developments.

Developers and industry groups have called for tax relief or reform, arguing that without it, many projects risk delay or cancellation.

4. Slowdown in project commencements

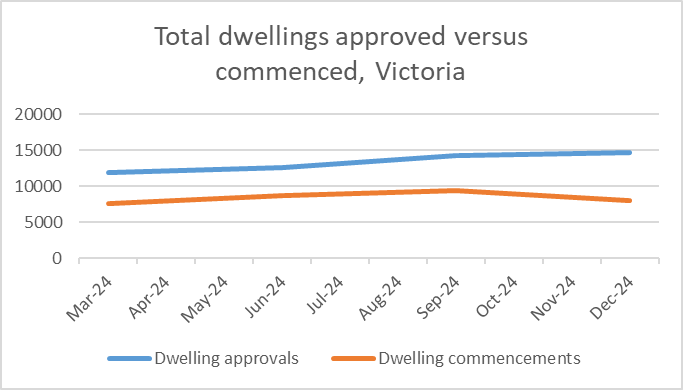

There’s now a widening gap between the number of dwellings approved and those actually under construction. As the graph below shows, ABS recorded 55,888 dwelling approvals in Victoria in 2024, but only 33,848 construction starts.

This gap may be due to financing difficulties, labour shortages, and cautious market sentiment amid affordability concerns – or all of the above. Whatever the cause, the result is a growing backlog of unmet housing demand.

What the shortage means for the property market

1. Continued upward pressure on prices

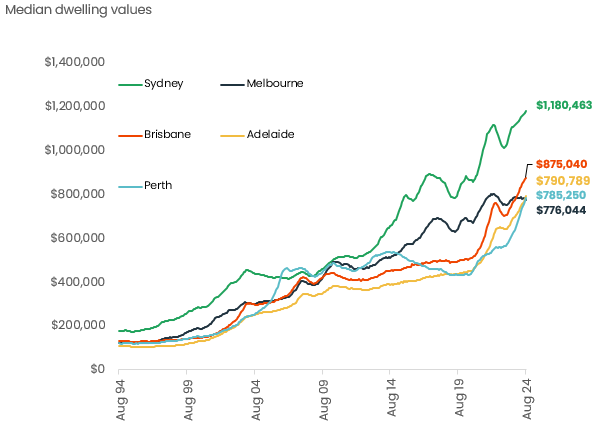

Despite a slowdown over the last few years, Melbourne’s property prices have turned around, increasing 1.2% since the beginning of the year, according to Cotality.

With housing supply already falling short, long-term demand is only expected to grow. Victoria’s population is projected to reach 10.3 million by 2051, according to the latest Victoria in Future projections. Annual growth is expected to average 9.7% by 2026 and 8% by 2036.

This sustained population growth, without a corresponding increase in housing, is likely to keep prices rising in the years ahead.

2. Rising rents and rental scarcity

Victoria’s rental market is tight, partly due to investors retreating amid tax hikes and in response to increased costs.

The number of rental bonds lodged in Victoria dropped by more than 20,000 in 2024, according to PIPA, following the increased land tax bills. This has reduced the overall rental stock and increased pressure on tenants.

Melbourne’s rental vacancy rate dropped to 1.8% in April, according to SQM Research and has hovered below 2% since early 2022. Asking rents have risen accordingly – up 2.0% in the 12 months to June – as competition for limited rental properties remains fierce.

Government’s response

The Victorian government has taken steps to try and boost housing supply and ease affordability pressures. The 2025-26 state budget included several initiatives:

- Extension of off-the-plan stamp duty concessions: Buyers of apartments, units and townhouses on strata titles will keep benefiting from reduced stamp duty on the land component until October 2026.

- Investment in infrastructure and housing: The budget committed $24 million to develop up to 300,000 new homes near tram and train hubs, and $12 million for planning 13,200 new homes with backyards in Melbourne’s outer suburbs.

Despite these measures, experts said the budget does not do enough to support homebuyers.

The HIA argued that more significant action, like planning reform that streamlines approvals, would do more to add to the state’s housing shortage.

Looking ahead

Victoria’s housing shortage is unlikely to ease without addressing the root causes: labour shortages, high construction costs, supply chain issues and taxation pressures.

That said, ongoing stamp duty concessions and targeted infrastructure investment may present new opportunities for buyers and investors – particularly in emerging development corridors.

With the state’s population set to continue growing, private investment will be crucial to easing the pressure on both the housing and rental markets.

For buyers and investors, working with an experienced mortgage broker can give you a strategic edge. A broker can help you find the right loan, maximise your borrowing power and navigate the finance process, so you can act with confidence in a competitive environment.

Thinking about buying your next home or investment property? Reach out to Axton Finance, a skilled mortgage broker in Melbourne, for expert advice and personalised loan options that put you ahead in Melbourne’s competitive market. Email us at [email protected] or click here to get in touch.