If the Reserve Bank of Australia (RBA) cash rate is so low, then why is your interest rate going up?

We are asked this question a lot.

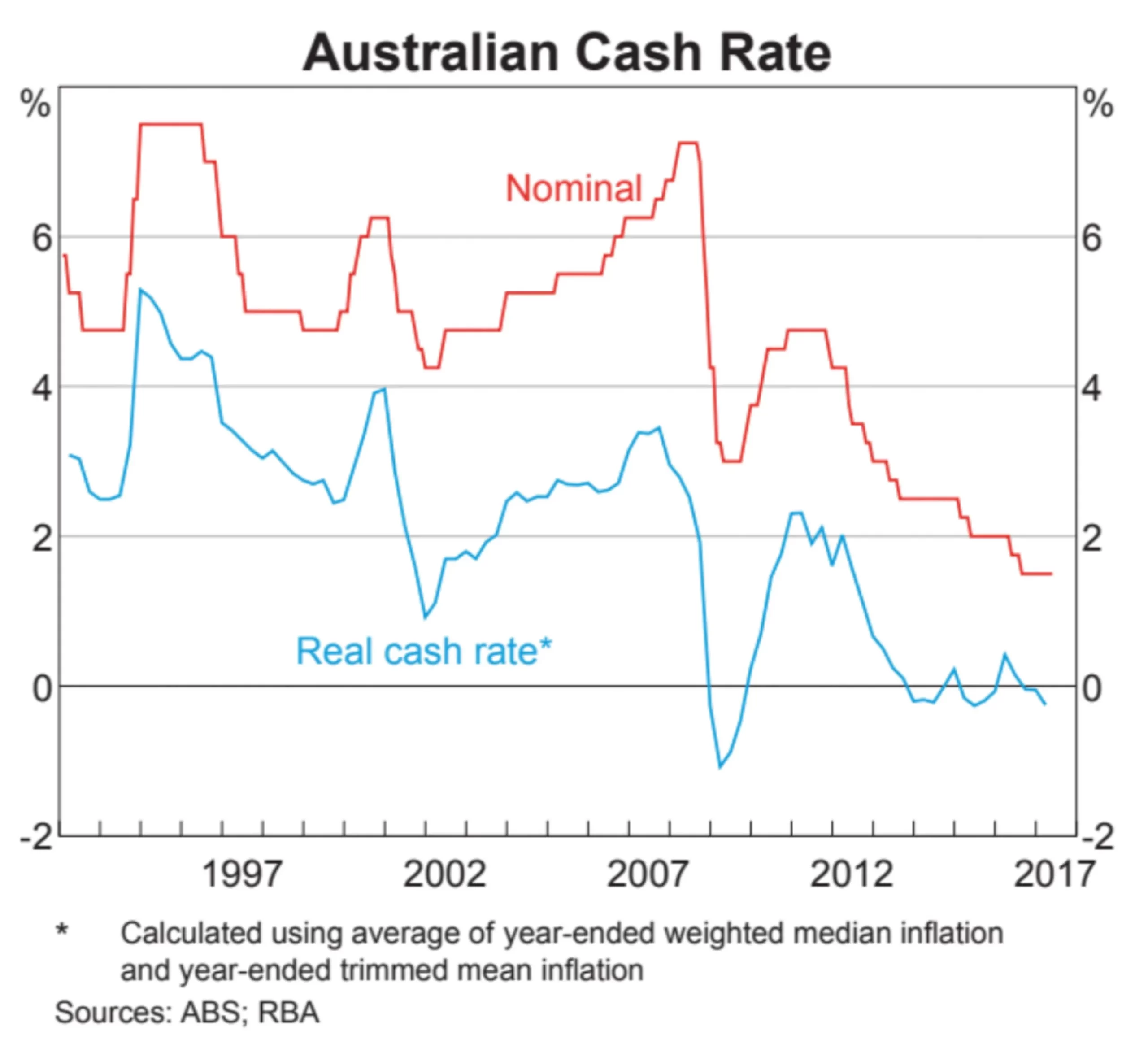

The official cash rate, as set by the Reserve Bank of Australia (RBA), has remained at 1.5%pa since August 2016 when it was then cut by 0.25%. The below graph shows the last thirty years of the official cash rate – you would have to go back to the 1950’s to see rates this low.

There are a few simple reasons why some rates are increasing. As you probably know in the past few years, we have experienced a boom in property prices (mainly only in Melbourne and Sydney though). This has resulted in significant growth in investment and interest only lending.

Interest only loans are of course an attractive form of mortgage lending as it reduces your monthly cash flow commitments but it does significantly increase the total cost of a loan over its effective life. You can actually simulate this using one of our online calculators to see for yourself here.

Most accountants and financial planners will rightly recommend that you setup your investment purpose lending as interest only (the theory being do not pay down a debt that gives you a tax deduction first if you have a home loan mortgage that does not). While this structure is in most cases a wise one, it has also seen a significant increase in owner occupied home loans that have been set up as interest only. This of course means that borrowers have had more cash flow available to them to either spend on more investment debt or, more worryingly so, on living and lifestyle expenses – without having to pay off what they owe.

The government has recognised this trend and has been concerned with the level of indebtedness that Australian households have taken on; coupled with low wage growth and rising house prices. When interest rates increase (and they will) and if left unchecked this could create significant economic pain for borrowers and the government alike.

Subsequently APRA (Australian Prudential Regulation Authority), the government body tasked with ensuring sound governance of our banking system, set a speed limit that states that lenders cannot exceed 30% of all new loans being interest only – which has been running at something closer to 40% of all new loans approved.

Until recently, interest only and investment lending has traditionally been priced at the same rates as owner occupied mortgages and even the same as interest only loans – so effectively the rate you paid was the same across the board regardless of what the purpose or structure was.

This has now changed so there are effectively four types of rates on the market (excluding fixed options) They are summarised as follows and ordered cheapest to most expensive;

– Owner Occupied – Principal and Interest (3.7%pa – 4.2%pa)*

– Owner Occupied – Interest Only (3.9%pa – 4.5%pa)*

– Investment – Principal and Interest (3.8pa – 4.5%pa)*

– Investment – Interest Only (4.2%pa – 5.00%pa)*

*Approximate interest rate ranges as at early July 2017

In summary – interest only and investment lending is now more expensive.

Mortgage lending policy is being tightened

As a result of these restrictions we are seeing significant changes in lending policies and rules across all lenders. In combination these rules have a direct effect of reducing demand for interest only and investment lending purposes.

Across the board there have been countless changes which cannot be summarised in this brief blog but at a high level they can be summarised as follows;

Reducing higher lending ratio loans

Generally higher lending ratio loans for investment and interest only lending are being capped at around the 90% loan to valuation (LVR) ratio with strong pricing incentives for borrowers to be at 80% or less.

Increased stress testing of borrowers

While the mainstream media may have made broad brush statements about irresponsible lending by the nation’s banks and lenders, this is simply not quite true. Banks have always maintained rigorous assessment criteria and have always sensitised interest rates in their calculations to account for a ‘what if’ scenario for when, not if, interest rates rise. Most lenders test borrowers for affordability at around 7.0% to 8.0%pa and apply minimum benchmarks to acceptable living allowances to determine affordability.

This latter requirement has come under significant scrutiny recently with most lenders demanding borrowers to summarise their own basic living expenses which will be compared against the banks own standards (some lenders now will also index living expenses according to the amount of income an applicant earns with those on higher incomes having higher minimum living expenses applied.).

Lender rules first, rates second

In this environment, more than ever before, it is important to get quality advice around your finance options. There are significant differences between what one lender’s rules are and anothers. There may be a slight difference in the rate but a huge difference in policies that will affect your ability to be approved, your structure and of course your total borrowing capacity.

What you can do about it

Fortunately there are a few simple things you can do about it. If you are completely unsure then just get in contact with us here or fill out our FREE mortgage health check link here

A few recommendations include;

- Consider fixing some of you loan

Some of the lenders are offering some pretty attractive fixed terms that are the same or cheaper than many variable investment and interest only loans. With the likelihood of further increases for this sort of lending, now would seem like a pretty good time to consider your options around locking in a near historical low rate

- Switch to Principal & Interest

Given that the banks are under significant pressure to reign in interest only lending taking a principal and interest repayment is attractive to all lenders these days and they have priced their products accordingly to increase demand for principal and interest repayments. It does of course increase your monthly repayments but you are paying down the loan and ultimately paying much less interest in the long term

- Set up an offset account

If you have some funds sitting in a interest bearing account it can be a suitable option to put the same funds into an offset account. The effect is it reduces the balance of your loan and interest charged on your mortgage by the amount you have in offset (eg $10k in an offset account reduces the balance of a $100k loan to an effective balance of $90k). The rationale being that an interest bearing account may earn you a poultry 2.0%pa currently, less tax, less the effect of inflation and you aren’t really going anywhere. Where an offset account saves you interest at a much higher rate with nil tax payable on the saving. Consider it that saving money is better than making money.

- Ring your current lender

You might be surprised at how a simple phone call may result in you getting a better rate. The recent rate increases have been a pretty broad brush 0.15%pa increase here or a 0.3%pa increase there on top of whatever you are paying. If your product is out of date and hasn’t been looked at recently you could be paying well above what is available currently. It also helps to use the magic words ‘Im looking at refinancing what can you do for me?’

- Refinance to a new lender

There are dozens of lenders out there and you might just be better off refinancing to a new lender. We can of course give you some options around this. Here are two useful tools to help you start that process.

We hope that this helps shine some light on the current situation around why mortgage interest rates have been increasing recently. As mentioned please feel free to contact us here or call the office on 1300 706 540 to discuss your option tailored to your scenario.