After a challenging few years, Melbourne’s property market is staging a comeback. New data confirms that the city’s long-awaited price recovery is taking hold, driven by a combination of relative affordability, population growth, easing economic pressures and renewed buyer confidence.

What’s happening with property prices?

Melbourne home values are rising again. PropTrack’s June 2025 home value index revealed that dwelling values climbed for the fourth consecutive month, taking annual growth into positive territory (1%) for the first time in over two years.

The city’s median house value now sits at $979,000, with units at $609,000.

Domain expects this growth to continue, forecasting Melbourne’s median house price to hit $1.11 million by the end of the 2025-26 financial year – a 6% increase year-on-year. That would mark a full recovery from the 2022–2024 downturn. Units are projected to climb 5% to $584,000.

What’s behind Melbourne’s rising property prices?

Affordability advantage fuels demand

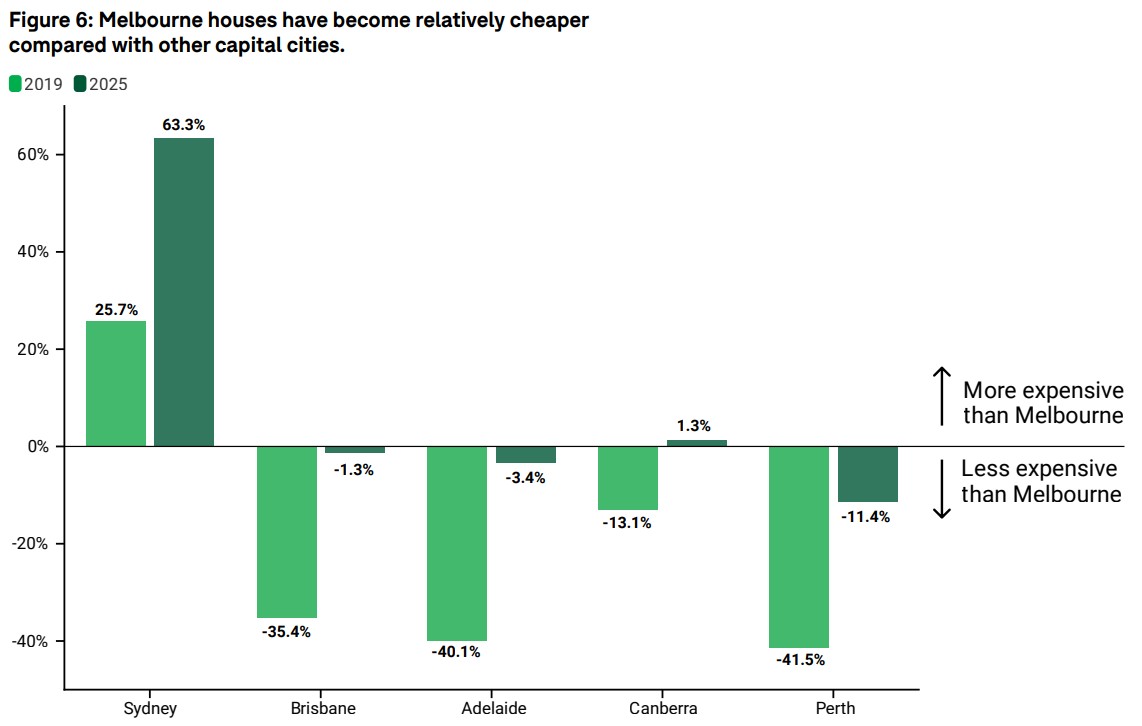

One of Melbourne’s key selling points is its relative affordability compared to other major cities. In 2019, Sydney houses were 26% more expensive than those in Melbourne, according to Domain. As the graph below shows, by March 2025, that gap had grown to 63%.

Meanwhile, Brisbane and Perth have now caught up to Melbourne on price, eroding the cost advantage they offered in recent years.

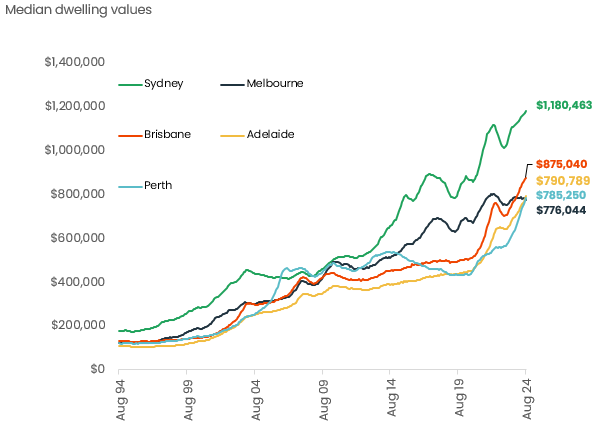

In fact, as of June 2025, PropTrack’s data has Melbourne ranked sixth-most expensive city for median dwelling value, behind Sydney, Brisbane, Canberra, Adelaide and Perth.

This shift is drawing interest from price-sensitive buyers and interstate investors, particularly as borrowing conditions ease.

Strong population growth

Another factor bolstering Melbourne’s outlook is population growth. After falling behind during the pandemic years, in 2024 Victoria’s population grew at the second-fastest rate of all states at 1.9%, according to the Australian Bureau of Statistics.

The state accounted for 30% of the nation’s total population increase, its largest share in over a decade.

This growth drives long-term demand for housing. More people mean more competition for properties, particularly in high-demand suburbs close to employment, education and transport hubs.

Interest rate cuts boost buyer confidence

A timely driver behind Melbourne’s property market turnaround has been the Reserve Bank of Australia’s (RBA) recent interest rate cuts. After a prolonged period of rate hikes aimed at cooling inflation, the RBA has now cut the cash rate twice in 2025, signalling a clear shift in monetary policy.

Lower interest rates have a direct impact on buyer sentiment and affordability. As mortgage repayments ease, more buyers can enter the market, and existing buyers can stretch their budgets further. This creates increased competition for available properties, which in turn puts upward pressure on prices.

Although the RBA surprised markets by holding the cash rate in July, it is likely that there are more cuts to come. With inflation continuing to trend lower and economic conditions softening, many economists anticipate further reductions in the cash rate into 2026.

The RBA board itself forecasts the official cash rate will drop to 3.2% by mid-2026.

The prospect of lower rates is fuelling a sense of urgency among buyers hoping to purchase before the market accelerates further.

As borrowing capacity improves and confidence returns, interest rate cuts are helping to reignite the growth cycle, particularly in markets like Melbourne, where prices had previously stagnated.

What do buyers need to know?

Consider units if houses are out of reach

While both houses and units are experiencing growth, house prices are expected to recover fully from the 2022-24 downturn and reach new records by the end of the 2025-26 financial year, according to Domain.

Unit prices, while rising, are likely to lag behind and remain below their 2021 peak by June 2026. So while houses are leading Melbourne’s recovery, units offer a more affordable entry point.

Look beyond the inner suburbs

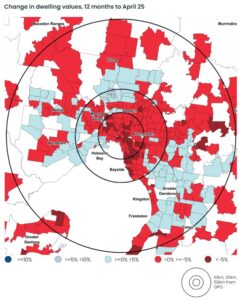

Outer and regional suburbs are playing a major role in Melbourne’s recovery. According to the Real Estate Institute of Victoria, Melbourne’s outer suburbs, such as Frankston, Frankston South and Rockbank have shown significant growth up 9%, 12.8% and 8.8% respectively in the June 2025 quarter.

Be ready to compete

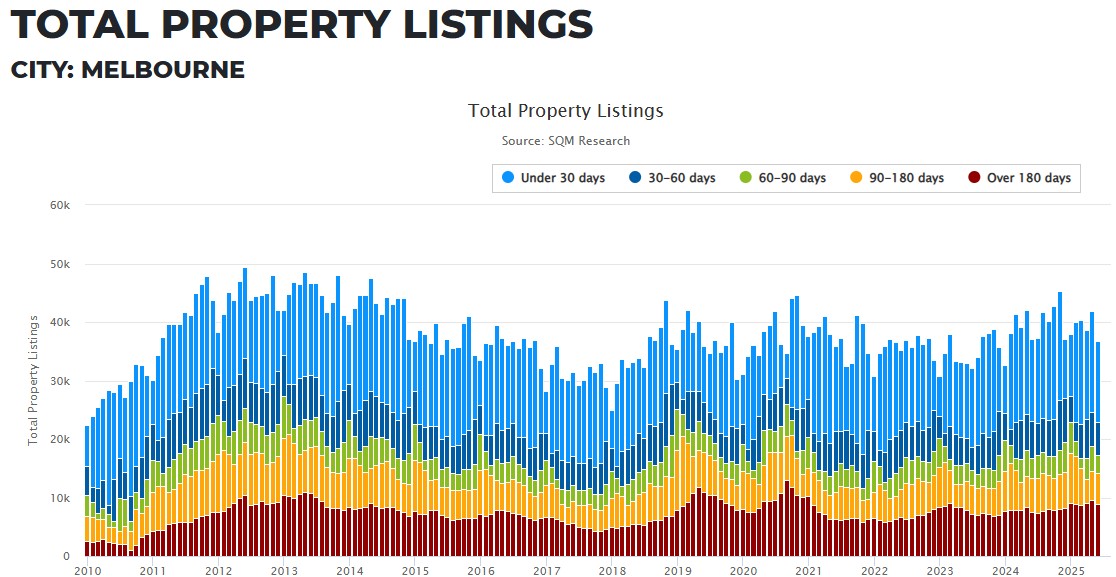

Buyer demand is picking up quickly, but the number of properties for sale hasn’t kept pace. Total listings were down 0.8% year-on-year in June, according to SQM Research, tightening supply and intensifying competition across many price points.

Get your finance sorted early

With prices on the rise, borrowing power improving and listings still tight, this is a critical moment for Melbourne buyers. Acting early, and with the right support, can make all the difference.

Having pre-approval in place and a clear understanding of your budget can give you an edge in a fast-moving market, especially when the right property doesn’t stay available for long.

Additionally, working with a Melbourne mortgage broker like Axton Finance, with a deep understanding of the Melbourne real estate market, can help you understand your options, secure competitive rates and act quickly when the right property comes along.

Ready to capitalise on Melbourne’s rebound? Axton Finance can help you make the most of today’s conditions. As a trusted Melbourne mortgage broker, we’ll guide you through your options, maximise your borrowing power and structure your loan for long-term success. Call us on 03 9939 7576, email [email protected] or click here to get in touch.