If you’re buying a property in Victoria, you’ve likely come across the term stamp duty. It’s a major cost that can add tens of thousands of dollars to your budget. But the good news is, you might not have to pay the full amount.

Whether you’re a first home buyer, pensioner or looking at an off-the-plan property, there are stamp duty exemptions and concessions in Victoria that could save you a significant amount.

However, these reliefs and eligibility rules can change frequently, so it’s important to stay up to date and get expert advice.

What is stamp duty and why does it matter in Victoria?

Stamp duty, also called land transfer duty, is a tax you pay when you buy property in Victoria and is paid to the State Revenue Office (SRO).

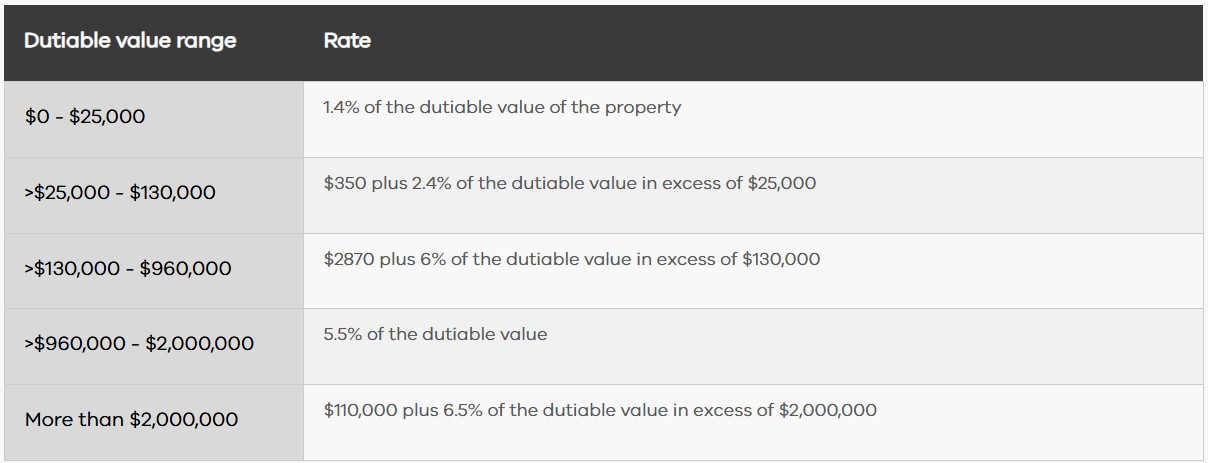

The calculation of stamp duty in Victoria is based on the “dutiable value” of the property. This is usually the higher of either the purchase price or the market value of the property. The rates are applied on a sliding scale, meaning the higher the property value, the greater the amount of stamp duty you’ll pay.

Land transfer duty for contracts entered into on or after 1 July 2021

Additionally, the usage of the property, such as whether it’s your primary residence or an investment, can also influence the duty payable.

Fortunately, various stamp duty exemptions and concessions are available to eligible buyers, helping to reduce this significant upfront cost.

Who is eligible for stamp duty exemptions in Victoria?

Victoria offers several pathways to reduce your stamp duty burden. Eligibility for these exemptions and concessions largely depends on your circumstances and the nature of the property purchase.

First home buyers

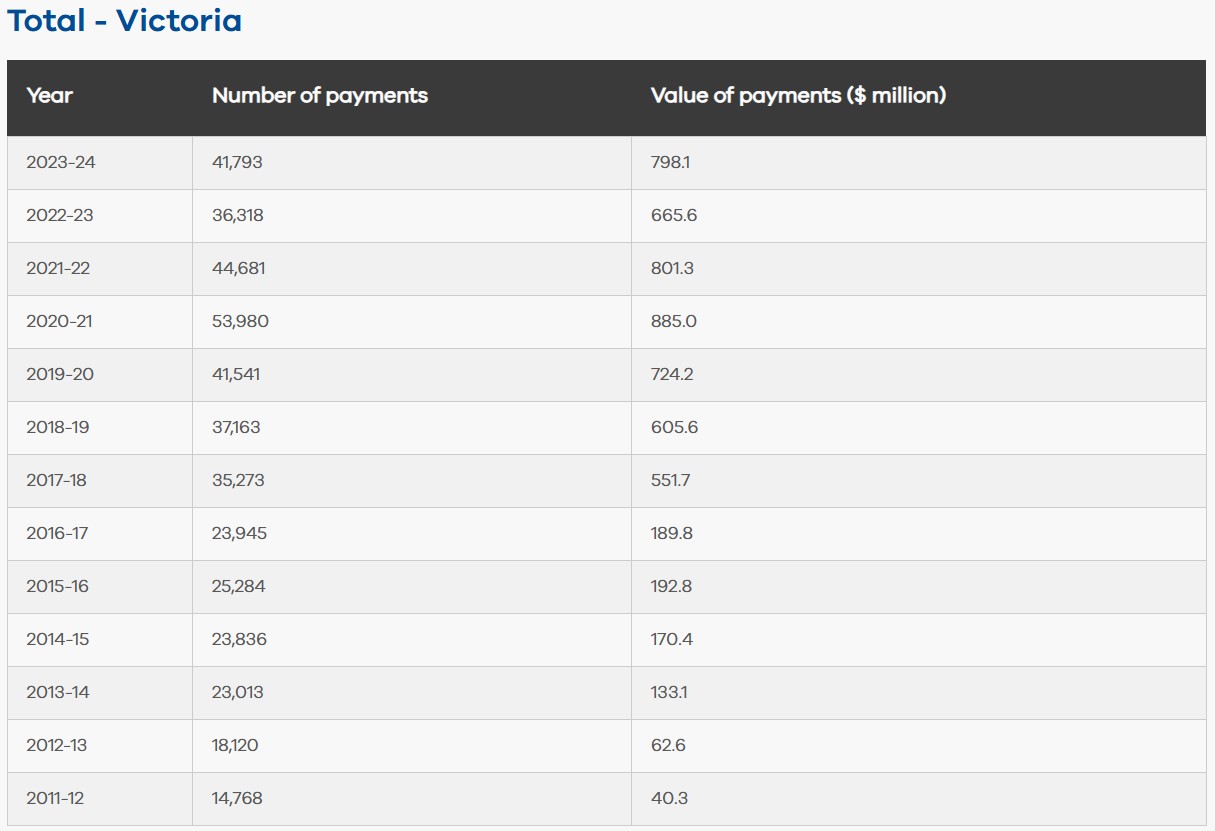

If you’re purchasing your first home in Victoria, you could join the more than 40,000 first home buyers who received stamp duty relief in the 2023-24 financial year, according to the SRO (see table).

The first home buyer Victoria stamp duty exemption or concession is only available to you once. If you or your partner has previously benefited from the first home buyer exemption, you can’t receive it again.

Pensioners

Eligible pensioners and concession card holders may qualify for a pensioner concession. If you’re purchasing a home valued at $600,000 or less, you may qualify for a full exemption. Homes valued from $600,001 to $750,000 may qualify for a concession. This only applies to properties that you intend to use as your principal place of residence (PPR). If you are buying your first home, you may also be eligible for other concessions and benefits.

Off-the-plan buyers

The Victorian government offers concessions for off-the-plan purchase, as well as a temporary concession (available until October 2026) for new builds in strata subdivisions with common property.

Principal place of residence

If you intend to live in the property as your primary home for a continuous period of at least 12 months, you may be eligible for a concession. This is available to all home buyers, not just first home owners, if your property is valued up to $550,000.

First home buyer stamp duty concessions in Victoria

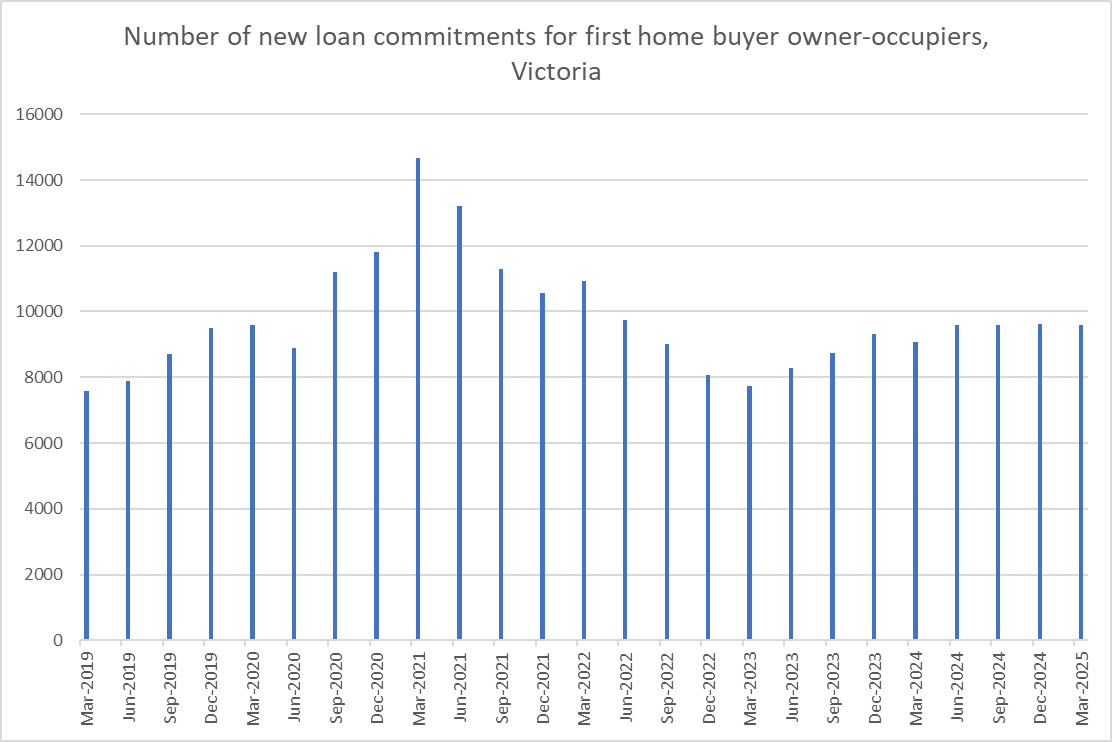

According to the Australian Taxation Office (ATO), 37,882 first home buyers took out new home loans for their PPR in 2024. This was an 11.2% increase from 2023.

If you’re one of the many first home buyers planning to purchase soon, knowing what financial relief you’re entitled to is a smart first step.

As a first home buyer in Victoria, you could receive:

- A full stamp duty exemption for properties with a dutiable value of $600,000 or less. This means you pay no stamp duty at all, representing substantial savings.

- A concession for properties with a dutiable value between $600,001 and $750,000. The amount of the concession scales down as the property value increases within this range.

For example, if your first home is valued at $595,000 you will pay no stamp duty. This saves you around $30,770.

If your home costs $700,000, your payable duty will be $24,713. But, without the first home buyer concession, this would jump to $37,070.

If you paid $800,000 for your first home, you are over the concession threshold and will pay the full $43,070 (unless other exemptions apply).

First home buyers in Victoria can benefit from both the stamp duty concession or exemption, as well as the First Home Owners Grant (FHOG). The FHOG is a direct payment for new homes, while the stamp duty concession is a reduction in the amount of land transfer duty you pay.

Off-the-plan stamp duty concessions: What you need to know

Buying off the plan (before construction or while it’s underway) may qualify you for stamp duty relief. In Victoria, there are two types of concessions that could apply:

1. Dutiable value concession

When purchasing an established home, you pay stamp duty on the dutiable value of your property. This is usually what you paid for it or the market value. However, for the off-the-plan concession, the dutiable value is the contract price minus the construction costs incurred after you signed the contract. As this reduces the dutiable value, you will likely pay less stamp duty.

For example, you make an off-the-plan purchase for $620,000. Of that amount, your builder says $465,000 will be used to construct your home. That means your dutiable value will be $155,000 (contract price of $620,000 minus construction costs of $465,000.

Eligibility for this concession can depend on your contract date and any other concessions you may qualify for. It is recommended you speak to a mortgage broker to verify.

2. Temporary off-the-plan concession

Introduced in 2024, under this concession, all buyers (including investors) are eligible for a concession on off-the-plan purchases within strata subdivisions that have common property. This can include apartments and townhouses.

The temporary concession was due to end in October 2025 but has subsequently been extended to apply to all eligible purchases up to 20 October 2026.

How to apply for stamp duty exemptions in Victoria

Applying for a Victoria stamp duty exemption or concession usually occurs as part of the conveyancing process. Your conveyancer or solicitor will typically apply for the exemption or concession as part of the electronic conveyancing process, but it’s good to understand the steps involved.

Here’s a general guide to the application process:

1. Gather all documents

You’ll need to provide documentation to prove your eligibility. This commonly includes:

- A copy of the contract of sale

- Title details and transfer of land documentation

- Proof of residency, if applicable (e.g. driver’s licence, utility bills)

- Concession card details for pensioner exemptions

- Any other supporting evidence for your claim (e.g. proof of being a first home buyer)

2. Complete the Digital Duties form

The SRO mandates the use of the Digital Duties Form for all land transfer duty transactions. This online form is where your conveyancer will declare details of your property purchase and apply for any eligible Victoria stamp duty exemptions or concessions.

3. Await response

Once submitted, the SRO will assess your application and notify you of the outcome. If approved, the stamp duty payable will be adjusted accordingly.

Common mistakes and things to consider when applying

While stamp duty exemptions or concessions can offer significant savings, it’s also important to be aware of the potential ways you could be disqualified and other common mistakes:

Buying over the threshold amount

Be vigilant about property values. If your property’s dutiable value exceeds the maximum threshold for a full exemption, you may only qualify for a concession or no exemption at all.

Using the property as an investment (when not allowed)

Some stamp duty concessions in Victoria are conditional on the property being your primary home. Using it as an investment property or failing to move in within the stipulated timeframe (usually 12 months) can lead to your exemption being revoked and duty becoming payable.

Failing to meet residency requirements

For concessions tied to your PPR, you must generally reside in the property for a continuous period (at least 12 months). If your circumstances change and you cannot meet this requirement, you must notify the SRO.

Incorrectly completing documentation

Errors or omissions on the Digital Duties Form or supporting documents can delay your application or even lead to rejection. Double-check all details, including contract dates, prices and personal information.

Not accounting for other costs

Stamp duty exemptions only relate to the transfer of the land or property itself. You will still be responsible for other property costs including legal fees, conveyancing fees, building and pest inspections and loan fees.

How AXTON Finance can help you navigate stamp duty exemptions in Victoria

Understanding stamp duty exemptions in Victoria can be overwhelming – especially when it comes to eligibility criteria, property price thresholds and paperwork. That’s where we come in.

At AXTON Finance, we’re experienced Melbourne mortgage brokers, with a deep understanding of Victoria’s property processes. That means we know all the ways to save on your home purchase, including which Victoria stamp duty exemptions or concessions you may be eligible for.

From first home buyers to off-the-plan purchasers, our team works closely with you to make your home buying journey as smooth – and cost-effective – as possible.

Get in touch with AXTON Finance today for expert advice on loans, grants and exemptions tailored to your unique circumstances. Call us on 03 9939 7576, email getabetterrate@axtonfinance.com.au or click here to get in touch.