If you’ve been following the national property conversation lately, you’ll know Victoria has taken a few punches in the media. From new taxes to doubts around investment returns, some buyers are wondering whether it’s still a smart place to invest.

But when you strip away the headlines and look at the numbers, Victoria’s value proposition becomes clearer and in some cases, stronger than other states.

Land Tax: Not Always What It Seems

Let’s take land tax, one of the most debated issues for property investors in Victoria.

For example, on a land value of $1,000,000:

Victoria: land tax approx. $4,770 per annum

Queensland: land tax approx. $4,700 per annum

It’s the same, right?

But here’s the kicker – once the land value increases beyond here, Queensland’s land tax grows faster.

Let’s say the land value is $1.8 million:

Queensland: $17,700 per annum

Victoria: only $11,850 per annum

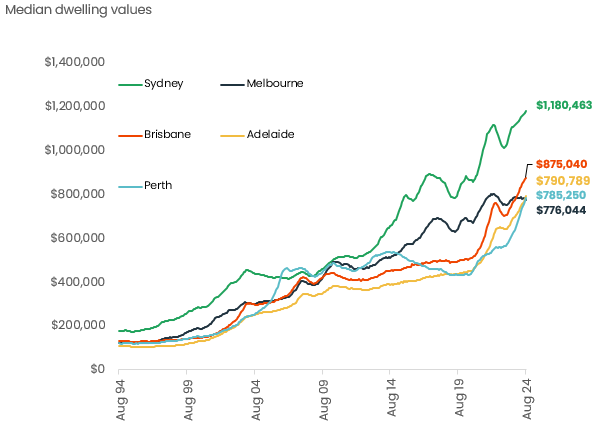

So while Queensland is often seen as the “investor-friendly” state, Victoria may actually be more cost-effective once you go over the $1M threshold and at a cheaper entry point also! Would you believe that Melbourne’s median dwelling value ($776k November 2024) is ranked sixth lowest among the eight capital cities in CoreLogic’s Home Value Index (HVI) report published November 2024.

How Other States Compare

NSW: Higher tax-free threshold ($1,075,000), but house prices are significantly higher, pushing you easily into higher brackets.

Tasmania: Flat 1.5% over $25,000 – resulting in ~$15,000 land tax each year on a $1.0m property!

WA & SA: Mid-range land tax, but with less capital growth opportunity given the strong bull run of the last few years.

NT: No land tax at all but limited investment-grade property and demand.

ACT: Land tax based comparable but based on a more complicated formula

What You Get for Your Money in Victoria

Melbourne and major regional Victorian cities offer more value per square metre than most other capital cities in Australia.

For example:

A $900k budget in Melbourne could buy a modest renovated home within 20-25kms of the CBD, in a well-established suburb with great amenity and infrastructure. In Sydney, that might only get you a pokey unit or if you are lucky a townhouse much further from the city.

Plus, Victoria offers:

- World-class schools, universities and infrastructure

- Rich cultural and lifestyle diversity

- A long-term track record of capital growth

Source Corelogic https://www.corelogic.com.au

A Word on Sentiment

Yes, the mainstream media has been pretty harsh on Victoria in recent years. But sentiment is just that – sentiment.

Melbourne remains one of the world’s most liveable cities, with comparative affordability to the rest of the country, strong population inflows, and continues to see low rental vacancy rates and high competition for quality homes.

Victoria – Still the Place to Be

As the old number plates once said, “Victoria – The Place to Be.” Based on the number of interstate inquiries we have been fielding in recent months, we still believe this is the case.

So while taxes matter, when you run the numbers and compare them to other states, Victoria stacks up surprisingly well – especially for investors with landholdings close to or over $1M in other states.

Ready to Invest Smarter in Victoria?

At AXTON Finance, we help smart investors structure their investment property loans for long-term success. Our experienced team of eight licensed mortgage brokers have extensive experience in investment lending mortgage solutions – we’ve got your back.

Chat with us today obligation free on 03 9939 7576 or message us here.