Guest blog content written by Corey Wastle – Licensed Financial Adviser @ Verse Wealth

Most people will at some stage in life receive an unexpected amount of money.

It might be a gift, work bonus, lottery win or more commonly an inheritance.

These ‘windfalls’ are often used to pay down the mortgage and relieve financial stress. They also often will allow people to take on the projects they’ve always put off until ‘I have the money’.

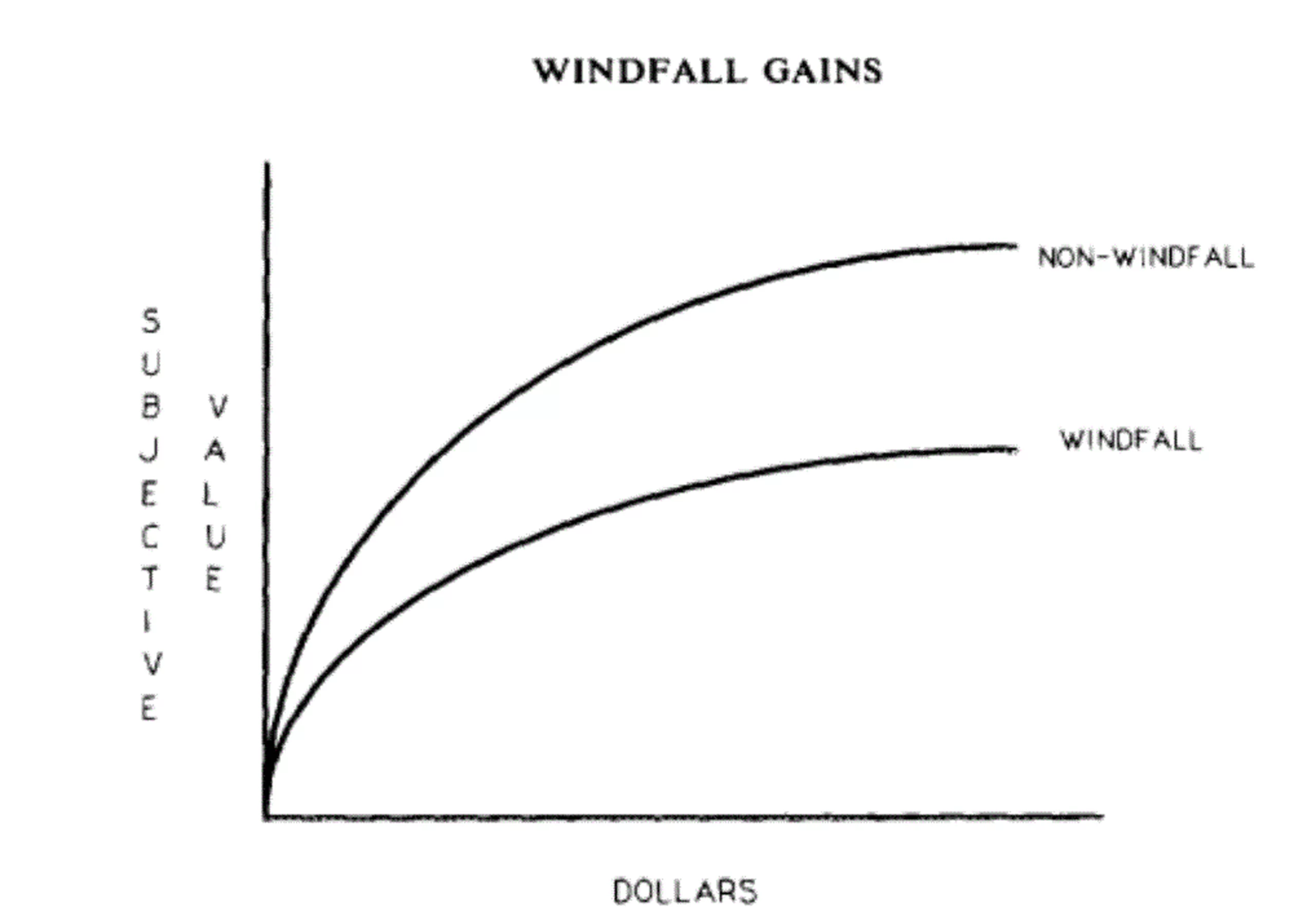

It’s a time of great opportunity however it can also be a time for careless expenses and poor decision-making. In fact, a large number of studies like this one show that windfall gains are spent far more readily than when effort is exerted to earn the money. These studies illustrate that when it comes to our perception of the value of the dollar, not all money is equal.

Windfall payments are often coupled with a spike in living costs. One-off expenses like new cars and international holidays, increase significantly. This happens because an unexpected lump-sum can be hard to contextualise against the money that we’ve always had to work so hard for. A large payment with no context is a very dangerous combination and it’s common to make some of our biggest financial mistakes during this time.

Fortunately, there are steps you can take to reduce the likelihood of making a serious (or series) of financial blunders after receiving a windfall. Here’s a few of our suggestions:

Find your baseline: Have a sound understanding of your weekly or monthly expenses and keep them unchanged until you’re ready to do something with the windfall. A quick or even steady rise in your expenses will see that precious money diminish faster than you thought possible. If you don’t already know your expenses, complete a budget planner to learn what they are.

Need vs Want: One of the most important questions to ask when making any big purchase is, ‘Do I need this, or do I want this?’ Regardless of your situation, ‘needs’ always come before ‘wants’. If you identify that you might not need the item, take the time to think about any things which you do need before spending your money on the wants.

Get ahead: Let’s cut to the chase – it’s not easy to get ahead when you’ve got a mortgage, kids, bills and little time. If you’ve been fortunate enough to receive a windfall, make sure that all or part of this money is used to move you closer to financial freedom. This will generally mean that you’re paying down debt or purchasing quality long-term investments, or even both. Don’t squander a rare opportunity. They’re rare for a reason.

Consider alternatives: If you’re thinking about making a big purchase with this money, ask yourself what else you could spend the same amount of money on. The new car or renovation to an already nice home might seem like a good idea at first thought but hindsight may leave you questioning this later on. Would you or your family be happier doing something else with this money? It can help to chat to a friend or family member – simply talking through your options can go a long way to clarifying what is truly important to you.

Corey Wastle – Licensed Financial Adviser

Please Note: At AXTON Finance we work with a number of professionals and professional firms (we call them ‘Advice Partners’) to help ensure that anyone in the AXTON community gets all the advice they require to get financially organised, on track and achieving the things that really matter. We have invested countless hours to find the best in accounting, financial planning, estate planning, family law, commercial law and buyers advocates based on their expertise and commitment to the highest level of client care.

We do not take referral fees or receive commissions from of our Advice Partners.