More homes are finally making it to market in Victoria, offering welcome relief for buyers and investors. That’s after Australian Bureau of Statistics (ABS) data shows a 5.9% increase in the number of dwellings completed in the 12 months to March 2025 when compared to the previous year.

This uptick suggests more homes are finally making it through the pipeline – welcome news for a market that’s struggled to keep pace with population growth and housing demand.

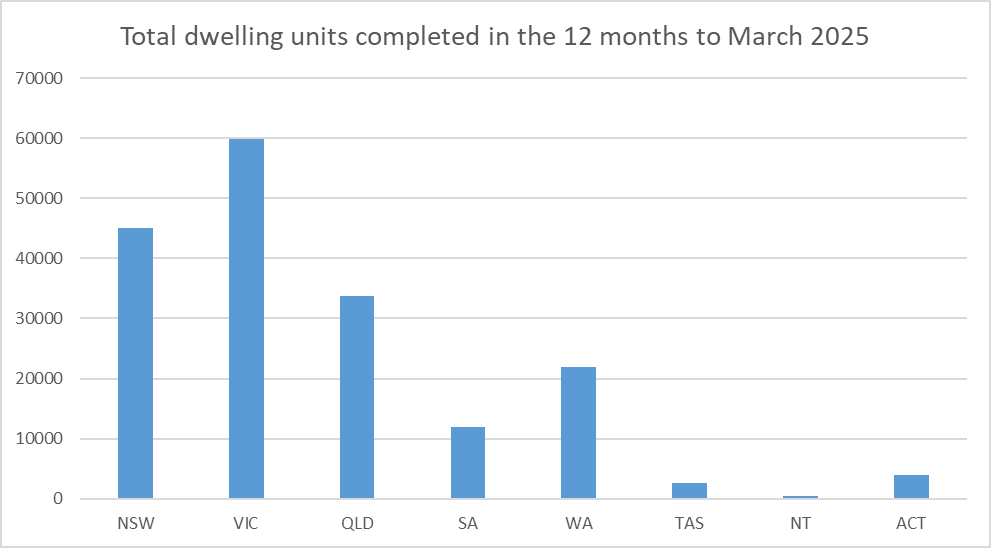

Victoria tops the charts for new housing completions

In total, 59,878 dwellings were completed across the state over the last year, according to the ABS. As the graph shows, this is well ahead of the next state, New South Wales, where 45,101 dwellings were completed.

Victoria has long led the pack on new builds, with more dwelling completions than any other state in every quarter since before the pandemic

Encouragingly, momentum is building earlier in the pipeline too. Victoria also topped the country for dwelling commencements, pointing to further supply increases on the horizon.

In the 12 months to the March 2025 quarter, construction began on just over 54,000 new dwellings, up 3.6% from the previous 12-month period. While most states and territories saw a lift over this period, Victoria’s increase was the largest.

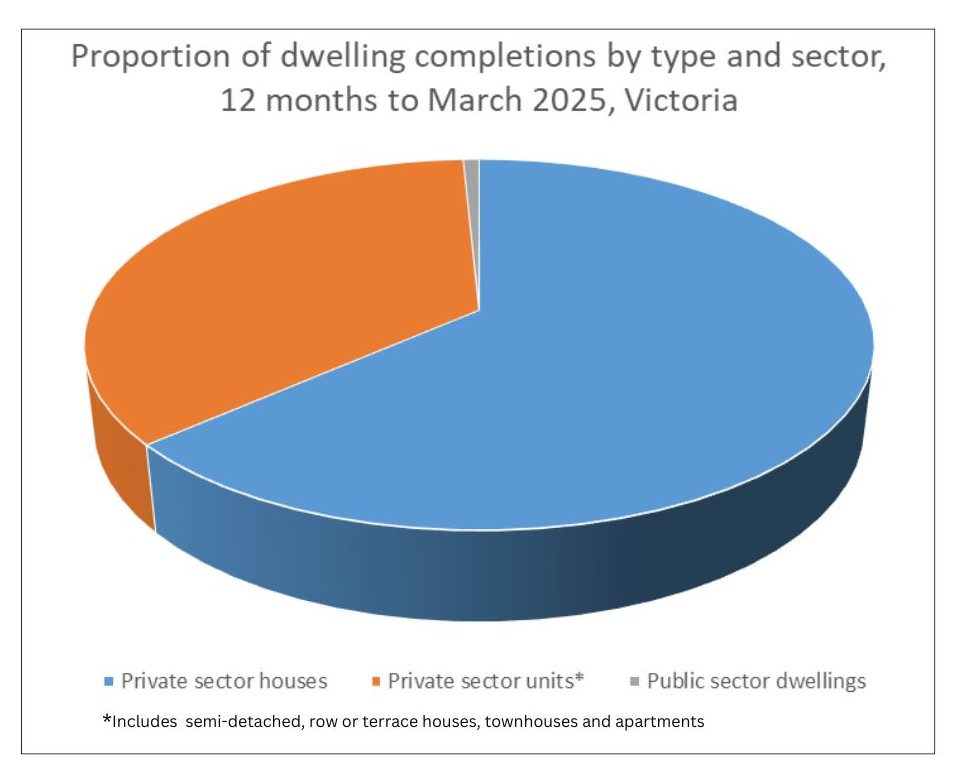

Detached homes driving growth

Most of the recent growth in new supply has come from detached houses in the private sector, which tends to dominate in outer suburban growth corridors. Of all dwellings completed in the past year, 63.5% were private sector houses.

The HIA’s data shows that Victoria’s growth in detached new home sales was part of a broader national trend. Two rate cuts and stabilising inflation have improved borrowing conditions and reignited interest in new homes.

New home sales are also up

The uplift in construction is also being backed by renewed buyer interest. Nationally, new home sales jumped 18.8% in the June quarter – the strongest result in nearly three years. Once again, Victoria is leading the way.

According to the Housing Industry Association (HIA), Victoria saw a 27.7% increase in new detached home sales in the June 2025 quarter compared to the previous three months. This was the largest gain of any state.

However, the HIA cautioned that sales volumes in Victoria remain low by historical standards. High land costs, long lead times and ongoing builder capacity constraints continue to limit supply.

Numbers remain below government targets

The Victorian government has set a target of building 800,000 new homes by 2034. Having started in 2024, this would require the delivery of 80,000 new dwellings annually. So, while the current improvements on commencements and completions are positive, numbers are still well below what is required in order to meet these state targets.

And, given that the goals were set based largely on population growth rates, if targets are not met, the housing shortage will likely persist, putting further pressure on the overall housing market.

Why is this important news for buyers?

For Melbourne buyers, especially those looking to upgrade or invest, rising completions are significant. More dwelling options, including house and land packages or brand-new builds, offer greater flexibility in terms of design, location and features.

More stock can also reduce competition in some parts of the market, easing price pressure and creating a more favourable environment for buyers.

For investors, new properties can offer strong depreciation benefits, lower maintenance costs and better tenant appeal. With population growth continuing to fuel rental demand, well-located new builds can deliver stable returns while avoiding the hidden costs often found in older homes.

What to consider when buying a new build

If you’re thinking about buying in Melbourne’s growing new-build market, here are a few key things to keep in mind:

Loan type

The type of loan you need will vary depending on the structure of your purchase. If you’re buying a house and land package or building from scratch, you’ll likely require a construction loan. These differ from standard home loans, with progress payments made at each stage of construction. Your broker can explain the process and help ensure your loan structure is right.

Due diligence

It’s just as important to do your homework on a new build as it is with an established home. Check exactly what’s included in the build price, assess the builder’s reputation, and confirm timelines and inclusions. A thorough contract review can help prevent costly surprises.

Stamp duty concessions

In Victoria, off-the-plan purchases and newly built homes can qualify for stamp duty concessions or even full exemptions. These savings can be significant, so speak to your mortgage broker about what you might qualify for.

Talk to a broker before you buy or build

With more new builds entering the market, buyers have more choice – but also more decisions to make. Choosing between build types, loan structures and available government incentives can be complex.

An experienced Melbourne mortgage broker like AXTON Finance can make the process simpler. We can compare suitable loan options, explain construction finance, help you access concessions and connect you with professionals such as conveyancers and building inspectors to support your due diligence.

By working with a broker, you’ll gain clarity, save time and feel more confident in your next property move.

If you’re exploring opportunities in Melbourne’s growing new build market, AXTON Finance can help you make a confident next step. Call 03 9939 7576, email [email protected]