Australians are becoming more conscious of how their homes affect both the environment and their wallets. Rising power bills and a growing awareness of climate change mean that energy-efficient housing is becoming a financial advantage on top of the environmental factors.

That’s where green home loans can help. Sometimes called sustainability-linked mortgages, these loans reward borrowers who build, buy or upgrade homes to meet specific environmental standards. Depending on the lender, you may receive discounted interest rates, cashback or waived fees for making eco-friendly choices.

What is a green home loan and how does it work?

A green home loan is a type of mortgage that provides financial incentives for energy-efficient homes. Lenders want to encourage sustainability because properties with lower running costs are often less risky – the theory is that borrowers save money on bills, leaving more capacity to meet their repayments.

To qualify, the property usually needs to meet certain benchmarks, such as a minimum NatHERS score or include specific green features like solar panels or water recycling systems. In some cases, lenders may require certification through programs such as the Green Star Homes Standard.

The benefits vary by lender but typically include:

- Discounted interest rates: Lower interest rates compared to standard mortgages.

- Cashback offers: Some lenders offer lump sum cashbacks upon settlement or upon proving that eligible green upgrades have been completed.

- Reduced or waived fees: Application or ongoing account fees may be reduced or eliminated entirely.

What types of properties and upgrades qualify?

Not every eco-friendly feature automatically qualifies for a green home loan in Australia, but lenders generally look for upgrades or builds that make a measurable impact on sustainability.

New builds

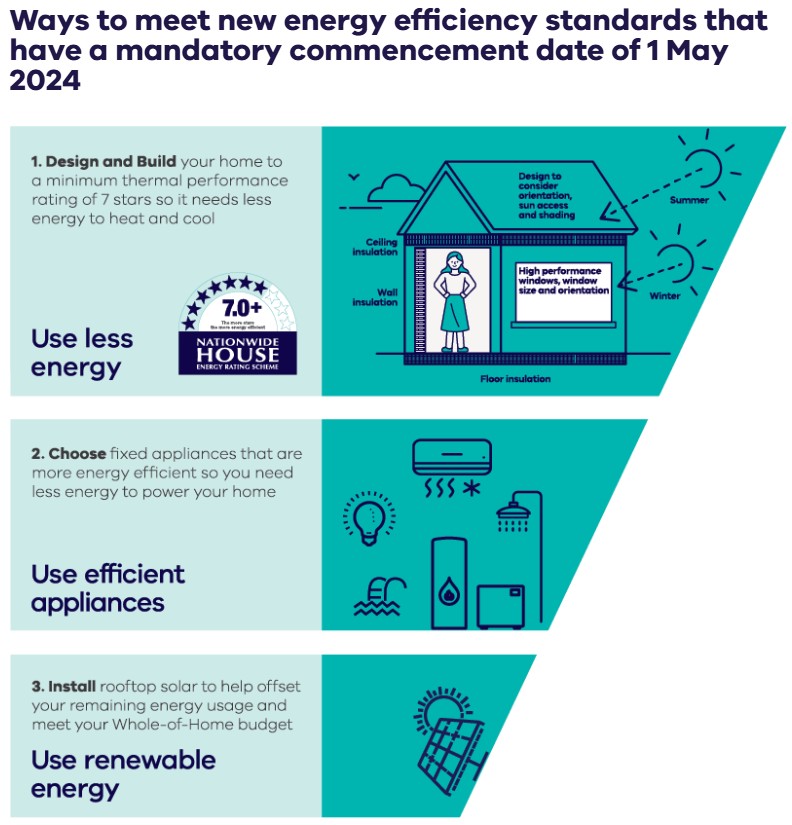

If you are building a custom home or investing in a newly developed property, qualifying is usually simpler. The property must be designed and certified to achieve a high energy efficiency standard, commonly a 6-star or higher NatHERS rating, before or shortly after completion.

In Victoria, this is particularly relevant because, as of 1 May 2024, all new homes and major renovations must now meet a minimum 7-star NatHERS rating. This ensures the building fabric is efficient, minimising the need for heating and cooling.

Existing properties

For homeowners looking to upgrade an existing home or renovate an investment property, the loan can link to specific improvements, such as:

- Solar panel systems (especially when paired with battery storage)

- Double glazing or low-E window treatments

- High-efficiency heating and cooling (like reverse cycle air conditioning or heat pump hot water systems)

- Superior insulation for walls, ceilings and floors

- Water recycling or rainwater harvesting systems

In these cases, a portion of the loan might be specifically earmarked for these upgrades, with the discounted rate applied once the installations and relevant certifications are confirmed. This ensures the financing is directly linked to eco-friendly home loan criteria.

For renovations, you may need to show before-and-after energy assessments or certification that the upgrades will improve your property’s performance to meet the lender’s standard.

Potential savings and benefits

The appeal of a sustainability-linked mortgage comes down to savings – both on repayments and running costs.

Interest rate discounts

While rate discounts vary between lenders, some lenders offer green loans that are between 0.10% and 0.40% lower than their standard rates. According to analysis from savings.com.au, standard home loan rates currently sit around 5.60% p.a., while some green loan rates are as low as 5.29% p.a.

If you borrowed 80% of Melbourne’s current median dwelling value of $805,880 (a loan of about $644,700), paying the standard rate of 5.60% p.a. would mean annual interest costs of roughly $36,100.

But, if you took out a green home loan for the same-priced home, at a rate of 5.29% p.a., it would reduce that to about $34,100 – a saving of around $2,000 a year, simply for choosing a property or upgrade that meets sustainability criteria.

Lower energy bills

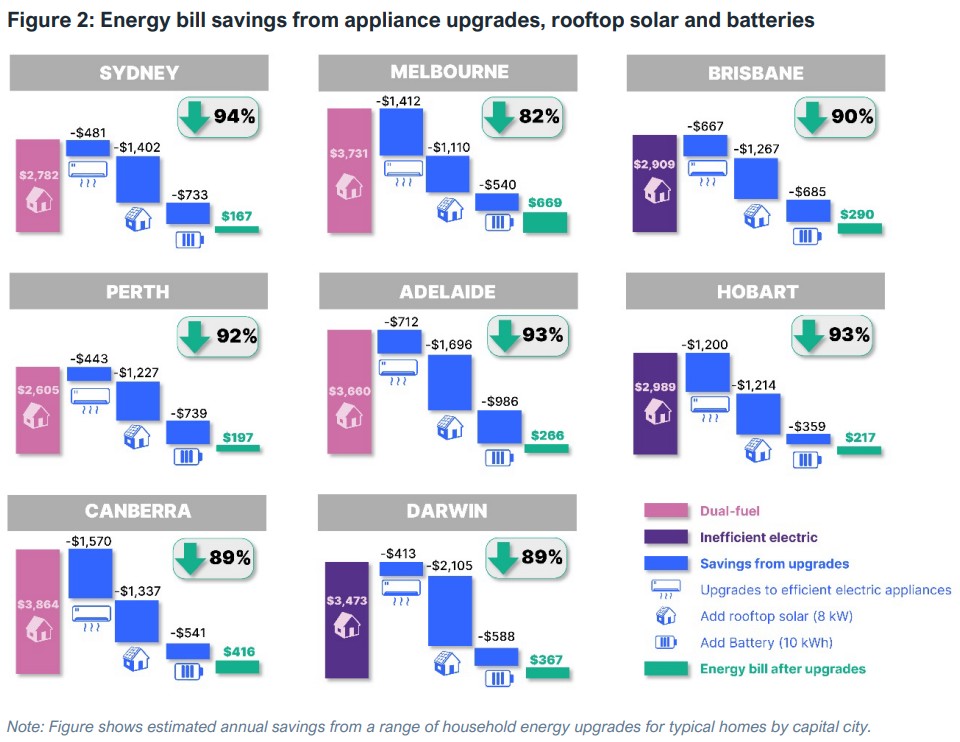

By investing in solar panels and energy-efficient design, households can dramatically cut their electricity bill. Analysis from the Institute for Energy Economics and Financial Analysis in July 2025 found that a combination of household energy upgrades, including efficient electric appliances, rooftop solar and batteries, could slash household energy bills by up to 82% in Melbourne.

Higher property value

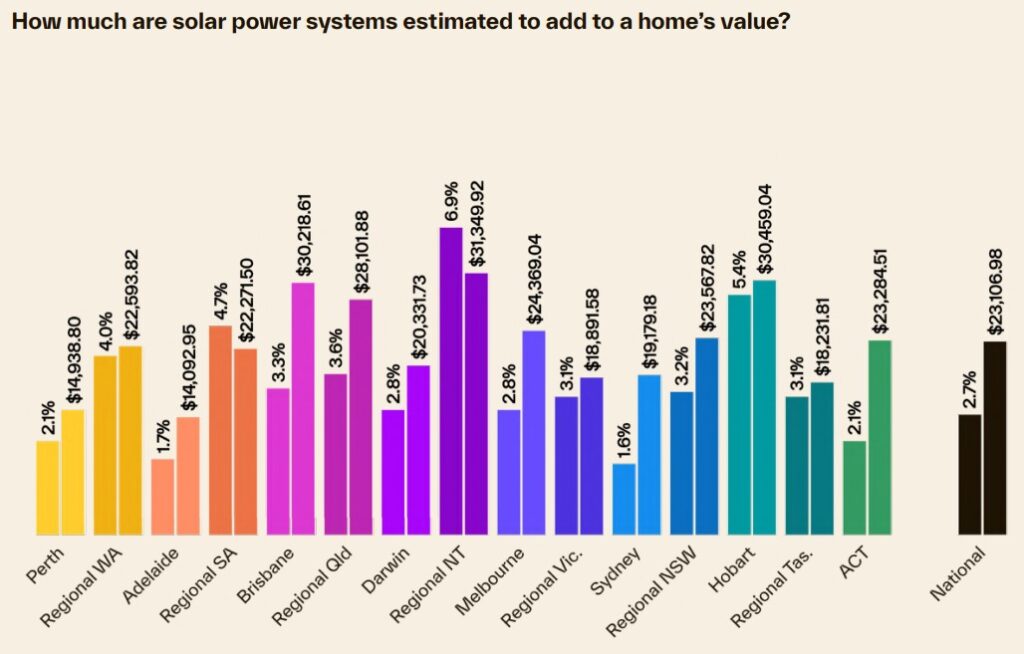

Research from Cotality found that homes with sustainable features often achieve stronger resale prices, as buyers look for properties that are cheaper to run and future-proofed against rising energy costs.

In Melbourne, a home with a solar power system can fetch an estimated 2.8% more on the median home value, equating to just over $24,000.

Possible limitations and considerations

While eco-friendly home loans can be attractive, they do come with conditions:

- Eligibility requirements: You’ll need to provide proof of your property’s energy rating or documentation of planned upgrades. Without certification, you may not qualify.

- Restrictions on loan funds: In some cases, the money must be used specifically for approved upgrades. That means less flexibility compared with a standard construction or renovation loan.

- Upfront costs: Solar panels, glazing and insulation can be expensive, even if they pay off in the long term. There are some state-run programmes that offer rebates for certain upgrades, which may help reduce these upfront costs.

- Market availability: Not all lenders in Australia currently offer green home loans. The choice is expanding, but options may be more limited compared with standard mortgages.

Who should consider a green home loan?

A green home loan in Australia is not for everyone, but it can be a smart choice if you:

- Are already planning renovations or upgrades that meet green criteria

- Care about sustainability and want your finance choices to reflect your values

- Want to future-proof your property against rising energy costs

- Are an investor who wants to improve rental appeal with lower utility bills for tenants

It is also important to note that, from 2027, rental properties in Victoria will be legally required to meet minimum standards for energy efficiency, safety and comfort. This could impact your decision to find a green home loan that suits your investment property needs.

Practical steps to apply for a green home loan

If you think a green home loan could be right for you, here are some steps to take:

- Research lenders: Look for banks and lenders that offer green or sustainability-linked products. Not all do, so the market can be confusing.

- Gather documentation: Keep records of your property’s energy rating, upgrade quotes and certification. These will support your application.

- Work with a broker: Mortgage brokers like AXTON Finance can compare lenders, explain eligibility criteria and negotiate on your behalf. This can save you time and help ensure you get the right structure for your situation.

Securing a green home loan

If you’re already planning to upgrade your home or purchase a new home with sustainable features, a green home loan can reduce both your repayments and your energy bills, while potentially increasing your property’s value.

The key is making sure the numbers stack up for your situation. Upfront costs should be weighed against long-term savings, and eligibility criteria need to be checked carefully.

With the right guidance, green loans can be a way to save money, improve your home and make a positive contribution to the environment.

Ready to make your home more sustainable and save money? Talk to AXTON Finance about green home loans. Our Melbourne brokers can secure competitive rates and finance eco-friendly upgrades. Call 03 9939 7576, email [email protected] or get in touch today.