Relocating your family home is a big undertaking. It can combine a significant lifestyle shift with an equally substantial financial decision. Whether you’re making a cross-suburb change, upgrading for your growing family or relocating for career opportunities, the logistics of buying before selling can feel overwhelming, especially when you’re juggling work demands and family responsibilities.

Do I sell first or buy first?

Here’s the scenario we see quite often: You’ve found the perfect new home, but your current property hasn’t sold yet. Do you risk losing your dream home by waiting for a sale, or take on the financial stress of potentially carrying two mortgages simultaneously?

Traditional mortgage structures often force you into an either-or decision that rarely aligns with market timing.

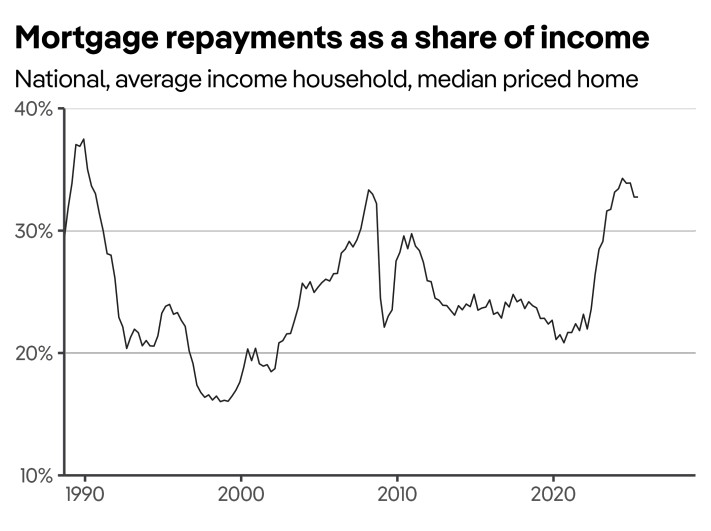

With Australians now needing more than 30% of their income to cover mortgage repayments, according to PropTrack and CommBank (see graph below), the financial pressure of relocating has never been higher.

Relocating in Melbourne’s tight market

One of the key challenges facing buyers in Melbourne in 2025 is the very tight market.

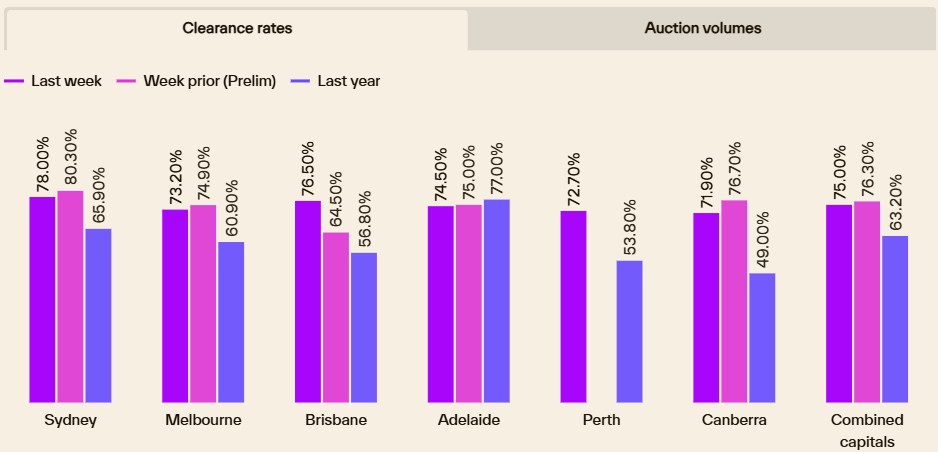

Total property listings are currently still low and declining, down 4.8% in August from the same time last year, according to SQM Research. At the same time, buyer demand is surging. Auction clearance rates, for instance, are up significantly, rising from 60.9% in early September 2024 to 73.2% in 2025, according to Cotality.

This combination creates a highly competitive environment. Good properties often sell within days, and many buyers feel pressure to commit before they’ve finalised the sale of their current home.

That’s where a relocation or bridging loan can make all the difference.

What is a relocation bridging loan?

A relocation bridging loan is a type of loan designed to help you buy your new property before selling your existing one. It acts as a short-term solution, covering the gap between the two transactions.

This type of loan provides the necessary funds to secure your new home without the pressure of coordinating settlement dates.

These loans typically offer six to 12 months from the time you settle on your new home to sell and settle your current one, giving you breathing room to:

- Secure the right property at the right price

- Prepare your current home for sale without pressure

- Avoid temporary rental costs and double moves

- Maintain stability for your family during the transition

What are the benefits of a relocation bridging loan?

There are several advantages to using a relocation loan to bridge the gap between buying and selling:

- Increases your options: You don’t have to wait for the sale of your current property before buying (especially in a strengthening market).

- Financial clarity: Your repayments and borrowing are structured in a single solution, so you can see the bigger picture.

- Time efficiency: You avoid juggling multiple loans or complex repayment schedules – ideal for busy professionals.

- Investment optimisation: Relocation loans can be used for both home and investment purchases, showing projected cash flow and portfolio impact.

Who can use a relocation loan?

This type of loan is not suitable for all property purchases but it can help several types of buyers:

- Upsizers and downsizers: This loan is suitable for people moving homes in Melbourne or interstate, providing clarity on cash flow, loan-to-value ratio (LVR) and settlement timing.

- Investors: Helps manage multiple properties, showing projected rental returns and portfolio LVR before committing.

- Busy professionals: Saves time and reduces the stress of juggling separate loans or manually calculating cash requirements.

What to consider before securing a relocation loan?

As with any home loan, there are some factors to keep in mind before you access a relocation loan:

- Interest costs: Relocation or bridging loans often come with higher interest rates (only during the usually short bridging period) than standard mortgages. It’s important you understand how the repayments will affect your cash flow, even if it’s only for a short period.

- Loan length: These loans are usually designed as short-term solutions. It’s important to have a clear plan for how and when the loan will be paid out once your existing property is sold.

- Lender requirements: Banks and lenders will want reassurance that the numbers stack up. This might include having enough equity in your current home and a realistic exit strategy for clearing the bridging loan.

AXTON Finance’s Next Purchase can help

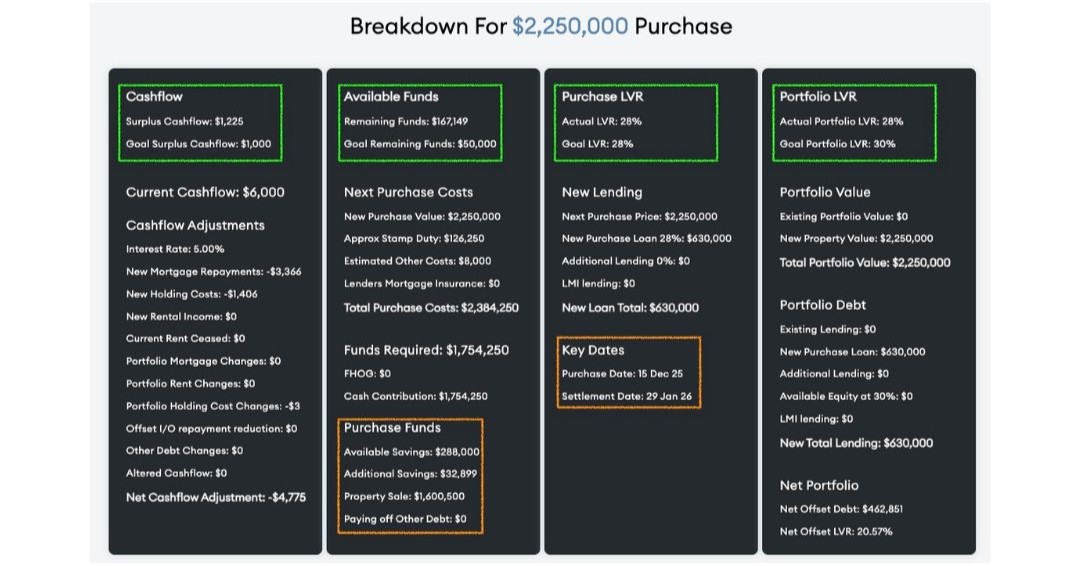

With so much to consider, our brilliant Next Purchase software takes the guesswork out of relocation finance.

This exclusive planning tool lets you model real-world scenarios with precision. Instead of relying on rough estimates, you’ll see exactly how different variables affect your financial position:

- Cash flow modelling: See your monthly surplus or shortfall after holding costs on both properties, including mortgage repayments, rates, insurance and maintenance.

- Funds required analysis: Get precise calculations for stamp duty, purchase costs and your cash contribution, so there are no surprises at settlement.

- LVR management: Monitor both your purchase LVR and overall portfolio LVR to ensure you stay within lending guidelines and maintain strategic flexibility.

- Scenario testing: Adjust variables like purchase price, sale price, interest rates or rental income to see outcomes instantly, allowing you to stress-test your strategy before committing.

Making your move with confidence

A relocation bridging loan can save time, reduce stress and protect your finances during a major move. The key is structuring it correctly and ensuring it aligns with your broader property strategy.

At AXTON Finance, we support clients through every step. We assess your borrowing power, structure your loan efficiently and provide access to tools like Next Purchase to test scenarios in real time.

If you’re planning to upsize, downsize, relocate or grow your investment portfolio, a relocation loan – paired with expert advice and our Next Purchase software – can help make your next move simpler, faster and more secure.

Planning your next move? Talk to AXTON Finance about how a relocation loan could make the transition smoother. Plus, our Next Purchase software can help you model all possible scenarios for your relocation. Call 03 9939 7576, email [email protected] or get in touch today.