Australia’s population is shifting. By 2050, more than one-third of Australians will be over 55, according to the Australian Bureau of Statistics. This means more people will be looking to downsize, which can unlock capital, reduce household burden and reposition your property assets for the next stage of life. But doing it well takes planning and a clear strategy.

Despite these clear benefits, many people hesitate. A recent report from PropTrack and GemLife, Downsizing Australia, revealed that 31% of potential downsizers cite moving hassle as their primary concern, while 23% simply haven’t found the right smaller home. Another 24% struggle with emotional attachment to their current property.

If you’re thinking about making a move, here are five tips to help make the transition financially rewarding and emotionally manageable.

1. Understand the financial impact before you commit

Downsizing isn’t simply about buying a cheaper property. The financial implications extend across multiple areas: stamp duty costs, moving expenses, potential capital gains tax considerations, as well as ongoing ownership costs.

To put that into context, let’s look at what downsizing to a median-priced home in Melbourne might cost.

A median-priced dwelling in Melbourne cost $805,880 in September 2025, according to Cotality. To purchase a home of that value, you would pay around $43,423 in stamp duty.

While the Victorian government does offer exemptions or concessions for eligible pensioners, the property price cap for this is currently $750,000, meaning many buyers in Melbourne won’t qualify.

Stamp duty is therefore a significant upfront cost that can quickly erode the equity you’ve built up in your family home. Add conveyancing fees, removalist costs and possible property styling expenses for your sale, and the transaction costs mount quickly.

Beyond these initial costs, it’s also important to look at how your ongoing expenses will impact your finances.

Downsizing usually lowers your mortgage, rates, insurance and maintenance costs, thanks to a smaller or lower-value property. But there may be additional expenses like strata fees (if moving into an apartment) or other property-specific expenses that could eat into these savings.

2. Prioritise the features that actually matter

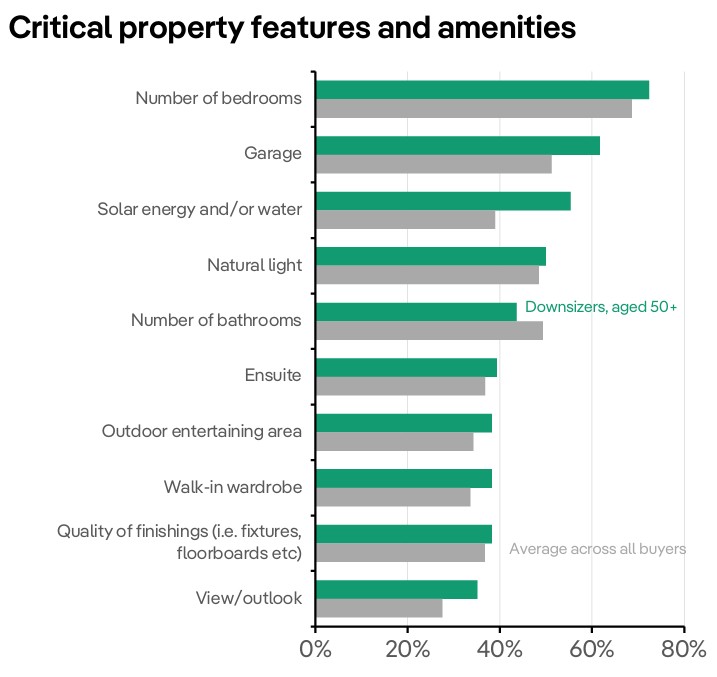

Not all properties suit the downsizing lifestyle. The Downsizing Australia report reveals clear priorities: 55% of downsizers consider solar energy and water systems essential (compared with just 39% of all buyers), while 62% require a garage for secure parking and storage.

This shows that practicality and efficiency outweigh luxury for most downsizers. Features that reduce ongoing costs or make daily life simpler – like renewable energy systems, low-maintenance gardens and secure parking – carry far more weight than aspirational inclusions such as large entertaining spaces or high-end finishes. For many, it’s about future-proofing their living situation and ensuring comfort and convenience without the burden of upkeep.

Location preferences also shift. Medical and health services rank significantly higher for downsizers – 47% versus 27% of all buyers – reflecting the need for easy, reliable access to care. Meanwhile, only 12% cite proximity to work as important, compared with 36% of the broader market.

This marks a clear move away from the work-life balance concerns of younger buyers towards lifestyle and well-being.

In short, the ideal downsizer property isn’t just smaller; it’s more efficient, lower maintenance and better connected to the services that matter.

3. Address the emotional barriers head-on

The decision to downsize involves both financial and emotional considerations. Downsizing Australia shows 24% of potential downsizers cite emotional attachment as a barrier. Yet many who have made the move say they regret not doing it sooner.

You can ease the emotional side by reframing the decision. Instead of focusing on what you’re leaving behind, think about the benefits a more manageable home can bring:

- Less home maintenance

- Reduced financial stress

- Easier day-to-day living with practical layouts

These tangible advantages can make the move feel less daunting. Downsizing isn’t just about letting go of a home; rather, it’s about choosing one that better fits your life now and into the future.

4. Keep optional flexibility

Downsizing doesn’t mean completely changing your lifestyle or sacrificing functionality. Even in a smaller home, having a spare room or multipurpose space is highly valued – not as a luxury, but as a way to maintain flexibility.

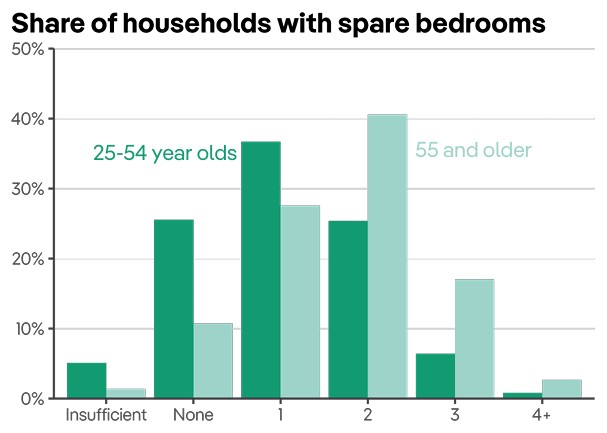

As the graph below shows, the Downsizing Australia report found that a large portion of homeowners over the age of 55 have two or more bedrooms, far more than younger homeowners.

Choosing a property with an extra room gives you options. Whether it’s for family visits, hobbies or a home office, that flexibility helps preserve your lifestyle in a smaller space.

5. Model different scenarios before making your decision

There are several important financial factors to consider when downsizing. What happens if you achieve a lower sale price than expected? How will rising interest rates affect your cash flow in the new property? If you’re considering keeping your current home as an investment, does the rental income justify the ongoing costs?

These are all scenarios you should stress-test before committing to your next move.

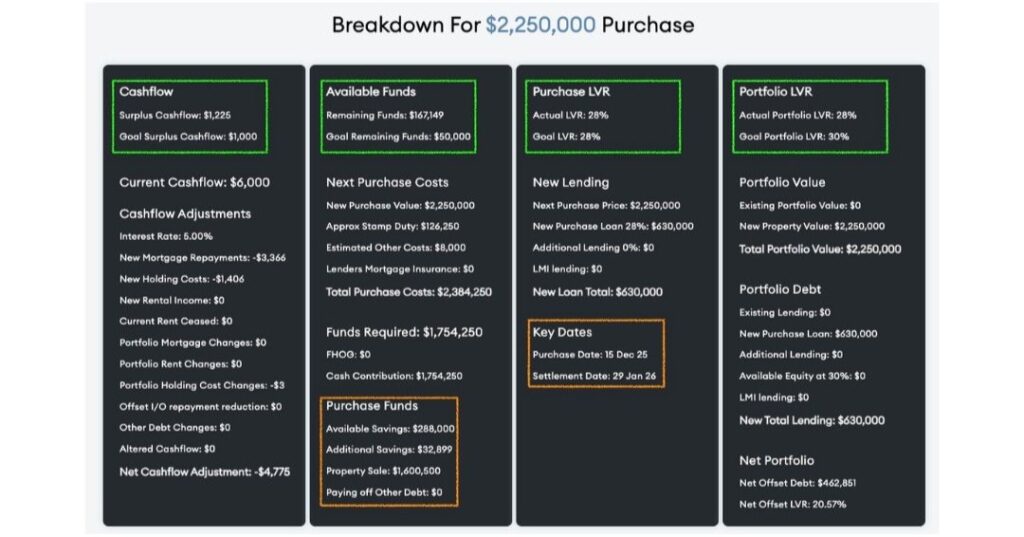

Luckily, at AXTON Finance, we’ve developed Next Purchase specifically for this purpose. This exclusive software allows you to model realistic outcomes tailored to your situation, adjusting variables such as purchase price, sale price, deposit, interest rates or rental income and see the results instantly.

Instead of static calculations, you can see:

- Monthly cash flow projections, including whether you’ll have a surplus or shortfall after all expenses

- Your loan-to-value ratio (LVR) on the new purchase

- Your overall portfolio LVR across all properties

- The exact funds required to complete the transaction, including stamp duty and associated costs

This level of detail gives you real clarity. You can test multiple properties, sale prices and finance structures, and find the one that suits your financial position best.

Make your downsize work harder for you

When done well, downsizing can free up capital, reduce ongoing costs, position you closer to family or medical services and provide a home that genuinely suits your current lifestyle.

Done poorly, it can leave you feeling cramped, financially stretched or regretful about what you’ve left behind.

The difference comes down to good planning. That means understanding the true costs, identifying the features that matter most to you, addressing emotional concerns honestly, staying flexible and modelling multiple scenarios before committing. These steps separate successful downsizers from those who struggle.

With the insights from an experienced mortgage broker like those at AXTON Finance, and a robust modelling tool like Next Purchase, the decision doesn’t have to be daunting. It can be a confident move into your next chapter.

Ready to explore your downsizing options? Contact AXTON Finance today for your complimentary Next Purchase consultation and discover how the right financial planning can transform your property goals. Call 03 9939 7576, email [email protected] or get in touch today.